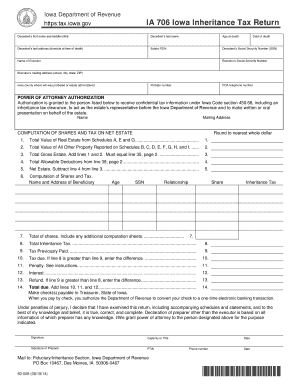

iowa inheritance tax form

It is different from the. LegalMatch can tell you how you.

Iowa collects inheritance tax for inherited property but tax rates depend on the degree of relationship of the beneficiary and the decedent.

. Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. In a matter of seconds receive an electronic. Tax Exempt Forms 3 Tax Exempt Florida.

This is a tax on the right to receive money or property owned by the decedent at the time of death. What is Iowa inheritance tax. If the return fails to.

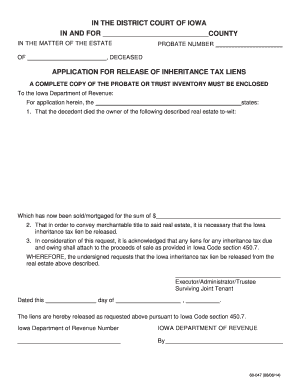

The personal representative is required to designate on the return who is to receive the clearance. Iowa Estate Tax Versus Iowa Inheritance Tax. This is something you need to take into consideration before preparing Iowa Last Will and Testament to avoid any legal fees and penalties from the IRS in the future.

The state of Florida requires businesses to file a Florida tax exempt form Florida Certificate of Exemption DR5 before selling certain itemsThe DR5. If a federal estate tax return form 706 United States Estate Generation-Skipping Transfer Tax Return is filed a copy of that return must be filed with the inheritance tax return. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons.

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Therefore the signNow web application is a must-have for completing and signing Iowa inheritance tax form 2011 112862 on the go. Therefore the signNow web application is a must-have for completing and signing 706 iowa inheritance estate tax return 2013 form on the go.

Inheritance tax clearance will be issued by the Department. In a matter of seconds receive an electronic. These tax rates are based upon the relationship of the beneficiary to the deceased.

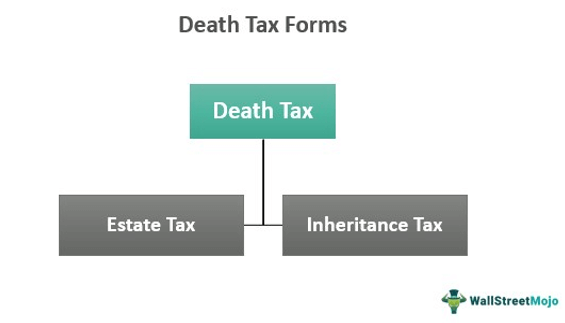

Iowa is one of several states that have an inheritance tax. An estate tax is levied against the entirety of an estate including any property monetary assets business assets etc owned by the decedent.

Form 60 047 Application For Release Of Inheritance Tax Lien

Fillable Online Iowa Inheritance Application For Release Form 60 047 Fax Email Print Pdffiller

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Form 60 007 Ia Inheritance Tax Check List

Free Iowa Small Estate Affidavit Form Affidavit For Distribution Of Property Pdf Eforms

Death Tax Definition Qualification Example How To Reduce

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

Application To Fix Inheritance Tax On Non Probate Assets Rw 1125 Pdf Fpdf

Iowa Power Of Attorney Form Ia 2848

States With Inheritance Tax Or Estate Tax Bookkeepers Com

Where S My State Refund Track Your Refund In Every State

How Does Inheritance Work And What Should You Expect Smartasset

Estate Tax Implications For Ohio Residents Ohio Estate Planning

Iowa Form 706 Fill Online Printable Fillable Blank Pdffiller

Iowa Inheritance Tax Law Explained

Iowa Law Relating To Collateral Inheritance Tax A Complete Compilation Of The Iowa Statutes Relating To Collateral Inheritance Tax With Annotations From The Courts Of Iowa And New York

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)